Beacon Roofing Supply: Ready For The Housing Downturn (NASDAQ:BECN)

photovs/iStock via Getty Pictures

“Generosity is supplying additional than you can, and satisfaction is having a lot less than you have to have.” – Khalil Gibran

Today, we place Beacon Roofing Supply (NASDAQ:BECN) in the spotlight. The shares have bought off not too long ago as 30-calendar year property finance loan charges have spiked to about 6 percent. The normal 30-yr home finance loan fee for the 7 days ending June 10th was 5.65{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7}, the highest stage due to the fact late 2008. The inventory looks low-cost on an earnings valuation, and the company has noticed some substantial insider getting from a useful operator here in 2022. Is the possible housing downturn currently priced into these shares? We test to response that problem by means of the investigation below.

Looking for Alpha

Business Overview:

Beacon Roofing Provide is headquartered just outside the house of D.C. The firm distributes residential and non-household roofing products, and complementary creating goods to contractors, home builders, setting up house owners, lumberyards, and a wide variety of different retailers. These merchandise incorporate gutters and sidings making elements, these as lumber and composite, skylights and window, plywood and OSB, decking and railing, HVAC goods and a wide range of other components/elements. The stock presently trades just north of $50.00 a share and sports an approximate market capitalization of $3.45 billion.

Initially Quarter Final results:

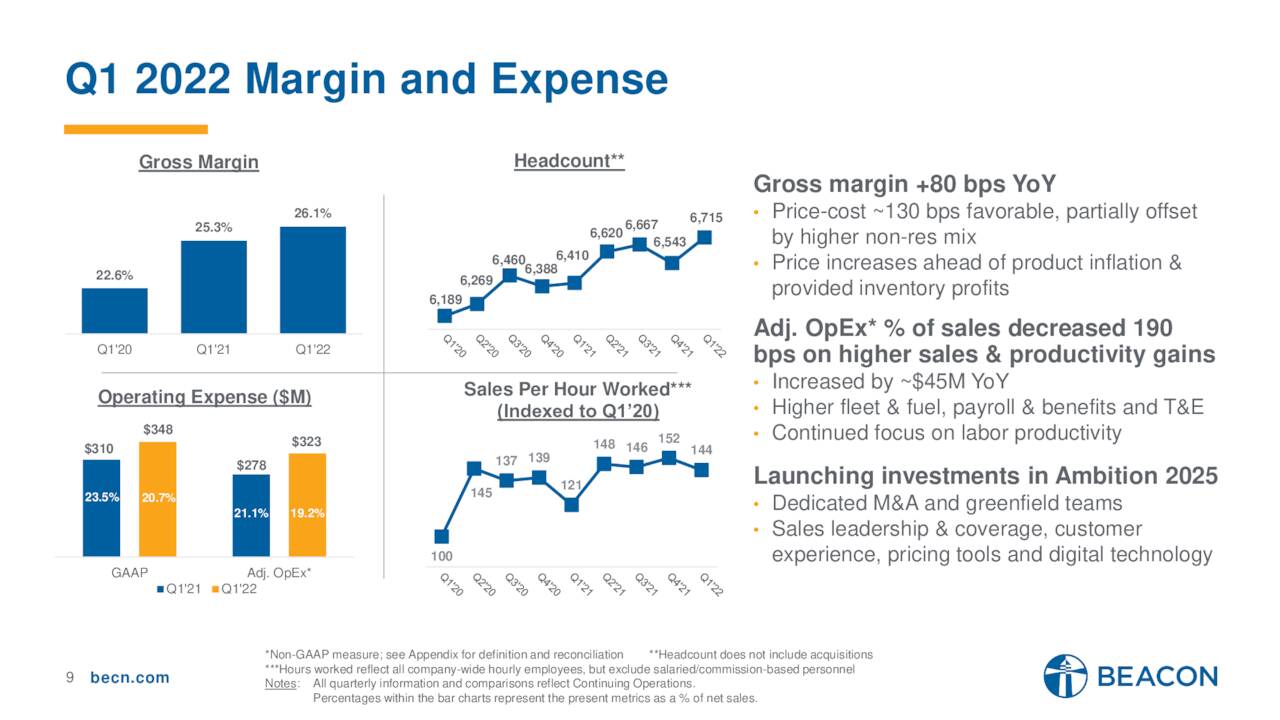

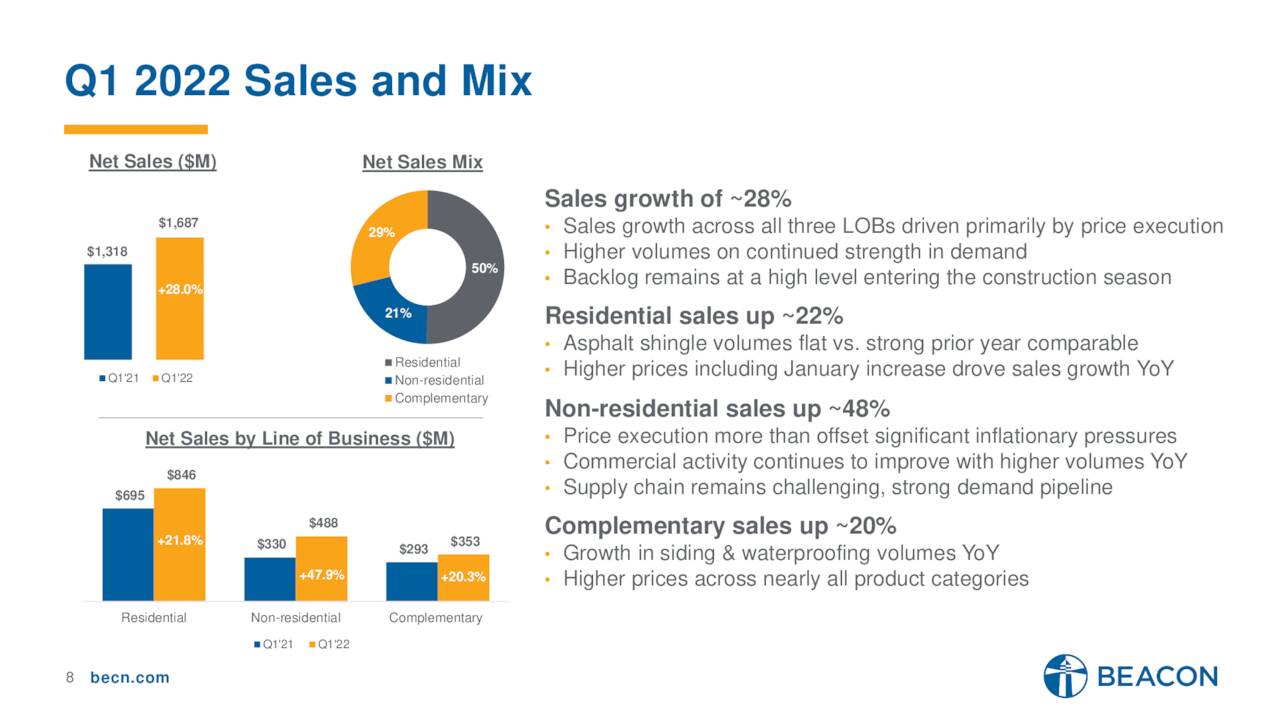

On May perhaps 5th, the organization reported very first quarter figures. The firm acquired 61 cents a share on a GAAP foundation as net income rose 28{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7} from the same time period a year back to just less than $1.7 billion. The two top rated and base line figures simply defeat analyst anticipations.

May possibly Firm Presentation

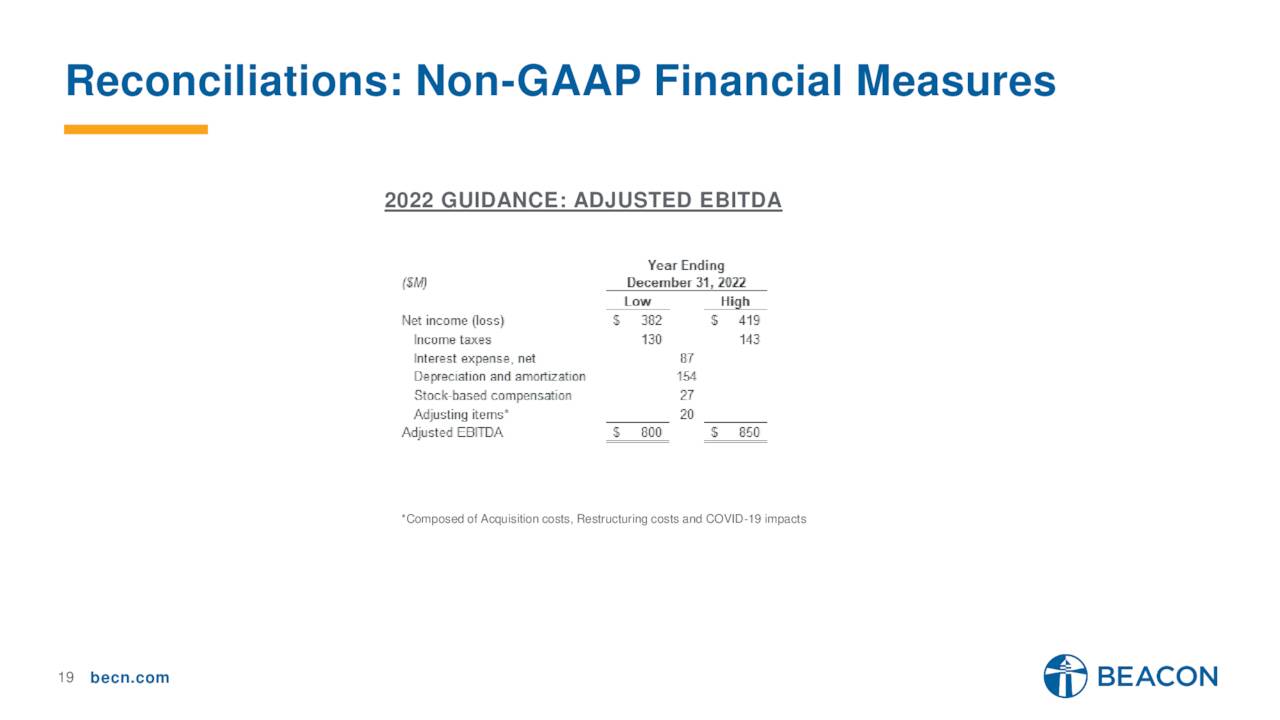

Margins improved in the quarter from 1Q2021, and administration thinks they will strike 27{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7} in Q2 of this yr. Leadership guided to 20{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7} earnings advancement in FY2022 and expects EBITDA to appear at $800 million to $850 million for the fiscal 2022 year.

May Corporation Presentation

Analyst Commentary & Stability Sheet:

The analyst community is combined on the prospects for Beacon at the instant. Over the earlier two months, 4 analyst companies which include Wells Fargo and Jefferies have reissued Keep or Neutral rankings on the inventory. Price targets proffered range from $60 to $72 a share. Meanwhile, a half dozen analyst corporations like RBC Capital and Stifel Nicolaus have reiterated Purchase rankings with rate targets concerning $70 to $83 a share.

A useful proprietor additional $6 million to their holdings in BECN in late April. This follows a different $6 million obtain in late January. A division president sold just about $250,000 truly worth of stock in mid-March. Individuals have been the only insider transactions in these shares so far in 2022. Just more than 4 p.c of the outstanding shares are currently held shorter.

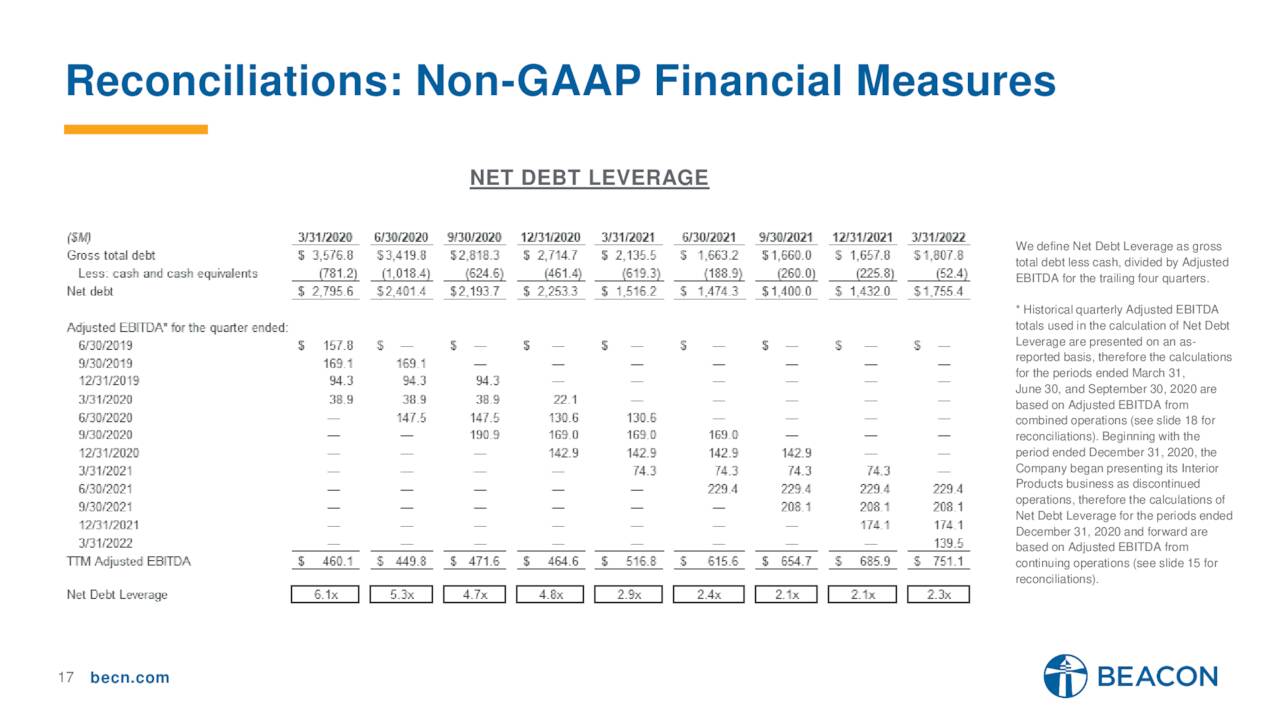

Might Company Presentation

The business finished the first quarter with just about $55 million of money and marketable securities from about $1.75 billion in extensive-expression financial debt. The company’s equilibrium sheet is in good form with internet financial debt leverage of 2.3, which is down from 6.1 at the get started of the pandemic. No significant tranches of financial debt are due until finally 2026. The enterprise is in the early levels of executing a $500 million stock buyback authorization. Beacon retired $113 million well worth of stock in the initially quarter under this software. Management expects to execute 3-quarters of this authorization in FY2022.

Verdict:

The present analyst business consensus has the enterprise earning some $6.80 a share in FY2022 as revenues rise some 20{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7} to $8.2 million. Following 12 months, they see comparatively flat earnings progress as revenues rise only in the reduced-single digits.

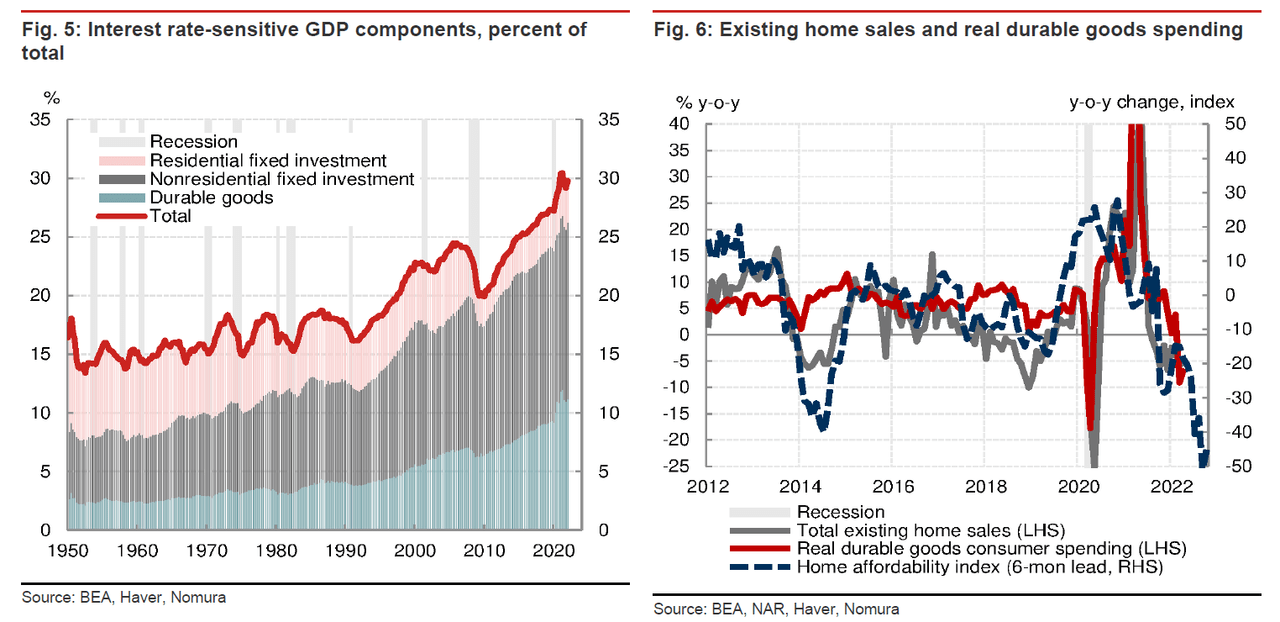

Beacon will of course be hurt by any sustained downturn in the household housing industry, which is most likely if home loan rates remain at these concentrations. It desires to be famous that this is not the identical scenario as the Housing Bust fifteen a long time back. The nation experienced found a long time of overbuilding prior to that party occurred. Housing commences have operate below extended-time period historic trends since then, and housing inventory remains anemic.

Could Business Presentation

In addition, roughly 50{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7} of the firm’s gross sales appear from non-residential and complementary products small business, which should really maintain up greater in a economic downturn. In addition, although housing commences are probable to fall, presented the lack of stock, they are not likely to drop off a cliff. Housing begins dropped 14.4{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7} in Could from the prior thirty day period to a 1.55 million annualized amount, the least expensive in additional than a yr.

Zero Hedge

A recession will also possible see curiosity prices recede eventually, and enter charges will drop as lowering demand from customers should assistance resolve global offer chain challenges. Lumber is down by approximately two-thirds from their all-time high late last calendar year as one instance that is already taking place. This need to assistance gross margins.

The question for investors is how deep a recession will be and what influence will it have on Beacon’s earnings. Even if just one slashes earnings projections by 25{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7}, the stock sells for just underneath 10 instances pessimistic revenue projections. The shares also trade at just about 6 times EV/EBITDA. Not ‘again up the truck‘ low cost but affordable valuations in a mild recession scenario. A advantageous owner sees the shares as a good long-phrase price judging from new buys. I will possibly hold out for the future offer-off in the in general sector to get a small ‘look at product‘ position in Beacon Roofing Offer through coated call orders.

“Way too several individuals devote income they haven’t earned, to buy items they do not want, to impress people that they will not like.” – Will Rogers