Beacon Roofing Supply Stock: Undervalued Turnaround Play (NASDAQ:BECN)

Melissa Kopka/iStock via Getty Pictures

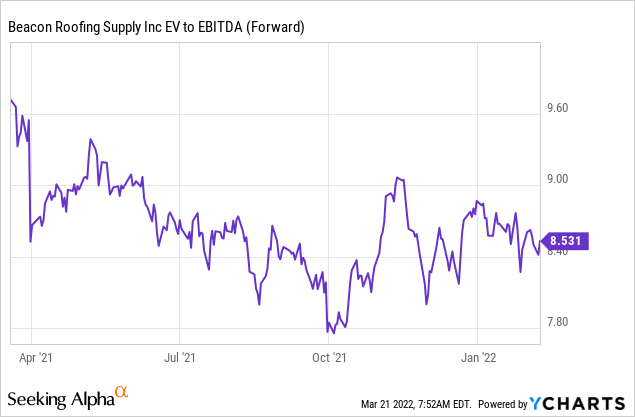

Beacon Roofing Supply (NASDAQ:BECN), the top North American roofing components distributor, at present holds an ~20{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7} share of the $28bn roofing current market, even though its concentration in re-roofing action (80{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7}) is a important differentiator offered the present inflationary backdrop. In modern years, BECN’s new management has also initiated a favourable turnaround, which, merged with cyclical tailwinds, has pushed profitability to file degrees and authorized for the deleveraging of its harmony sheet. With BECN now equipped with ample balance sheet potential to return meaningful money to shareholders about time, when also driving development by means of M&A, the current trough ~8.5x EV/EBITDA valuation strikes me as unwarranted. As BECN executes on its “Ambition 2025” program, I be expecting the inventory to re-fee greater.

Share Obtain Initiatives and Pricing Electric power Support “Ambition 2025” Targets

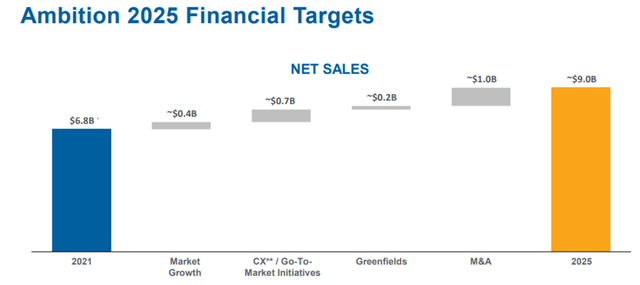

BECN is turning a new chapter with its aptly named “Ambition 2025” targets, headlined by a product sales CAGR of ~8{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7} and modified EBITDA margins of ~11{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7} in excess of the upcoming four a long time. This should come as welcome news provided it exceeds the prior steering of mid to higher one-digit revenue progress with margins also just earlier mentioned 2021 concentrations. The important driver of the ~$9bn product sales focus on by 2025 (vs. 2022 guidance of $7.1-7.4bn in revenue) is $700m from natural market share get initiatives (2.5{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7} CAGR) based mostly on BECN’s scale benefit and its on-time and entire (OTC) network product, alongside with its electronic and industrial income middle capabilities. All in all, BECN is effectively-outfitted to provide a robust assistance product in the market to aid growth within just its present shopper foundation and to acquire new accounts about the coming decades.

Beacon Roofing Supply

Supply: Beacon Roofing Source Trader Day 2022

Even if the current inflationary pressures very last for longer than anticipated, BECN really should keep on being resilient – given roofing products and solutions are non-discretionary (i.e., replacing a broken roof is far more of a will need than a want), BECN is perfectly-positioned to move rate raises alongside to its consumers. The non-discretionary nature of its earnings stream need to thus cut down its publicity to the broader housing market cycle, boosting visibility into its 2025 targets. Furthermore, the current operating setting favors BECN’s scale as even bigger gamers have the flexibility and negotiating leverage to superior mitigate COVID-pushed supply chain disruptions. With scaled-down gamers also most likely to endure, the present-day backdrop need to permit for consolidation, further helping BECN expand its profits via the cycles.

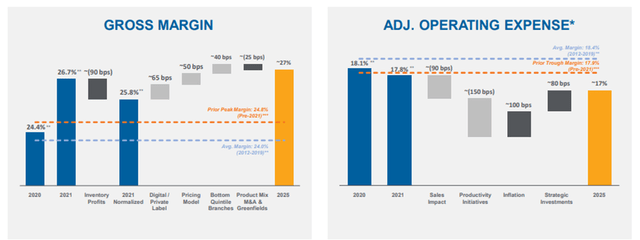

New Management to Unlock A lot more Margin Upside

Margin-wise, BECN has a vastly unique outlook from when it was a badly integrated roll-up pre-2020. Since BECN appointed Julian Francis (previously at Owens Corning (OC)) as CEO and Frank Lonegro (beforehand CFO at CSX Company (CSX)) as CFO, administration has amazed in the way they have turned about the enterprise and held skin in the video game (each have been buying stock). To recap, BECN’s gross financial gain margins and working gain margins have expanded substantially from 2017 to 2021 – gross financial gain margins are up to 26.5{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7} in 2021 (from 24.6{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7}), and operating earnings margins have expanded to 7.1{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7} (from 5.3{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7}). Utilizing the guided $7.3bn profits foundation for 2022, each 100bps translates to ~$73m, so the around 200bps expansion is product. Administration isn’t really completed nevertheless – BECN’s trader working day commentary indicates there is nonetheless more upside remaining to the margin profile.

Beacon Roofing Provide

Source: Beacon Roofing Offer Investor Day 2022

To a sure extent, the margin enhancement is attributable to cyclical tailwinds, with transitory stock benefits and mid-teens residential progress supporting a number of rate boosts (ranging from 5-30{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7}). That stated, I believe the structural margin advancement thus far is obvious and, crucially, continues to be in the early innings. Underlying the net expansion guidance to ~27{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7} gross margin by 2025, for occasion, is BECN’s digital and non-public label initiatives which are set to make ~65bps of expansion, adopted by its pricing model (~50bps) and enhancements to its underperforming branch (~40bps). The accretion potential of digital gross sales is notably compelling – assuming revenue roughly doubles in 2025 to ~25{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7} of overall gross sales (from 13.5{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7} in 2021), this entails ~$30m of incremental EBITDA technology provided electronic profits margins are ~150bps increased than offline. Meanwhile, private label sales (via the TRI-Created model) are also guided to be net accretive, with the $1bn in 2025 sales (vs. ~$600m in 2021) translating into ~$40bn of incremental EBITDA.

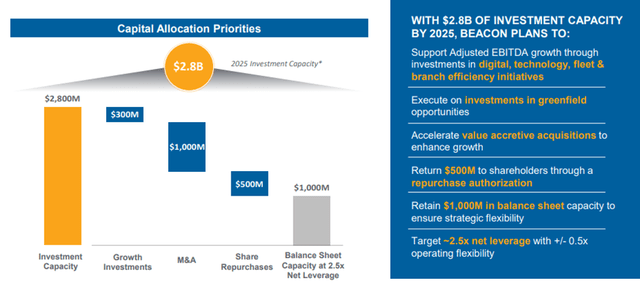

Cleaner Stability Sheet Supports Funds Allocation Upside

Pre-2020, BECN experienced been plagued by harmony sheet problems – not only from the COVID affect, but also as the integration of Allied Setting up Items was weighing on margins. Since 2Q20, however, when net personal debt/trailing modified EBITDA was at ~6x, leverage has given that declined substantially to ~2x as of Q4 2021. The de-levered harmony sheet has permitted BECN to refinance current debt in 2021 and prolong its financial debt maturities (the closest maturity is now for a $300m tranche owing in 2026). Adhering to the 2022 trader day, the leverage focus on now stands at 2-3x, and the company is restarting some tuck-in acquisitions. For each BECN estimates, it will produce $2.8bn of cumulative expense capability by 2025, of which ~$1 billion will be deployed toward M&A, ~$500 million to buybacks, and ~$300m towards growth investments (comprising digital, technologies, fleet and branch performance initiatives). Assuming the midpoint web leverage target of 2.5x, this implies $1.0bn of remaining financial commitment capacity, which could guidance equilibrium sheet adaptability for incremental investments or shareholder return. So, even though the recent plan earmarks ~$500m for share repurchase, the new CFO’s keep track of record of staying intense on buybacks at CSX signifies upside optionality on cash returns, in my view.

Beacon Roofing Supply

Resource: Beacon Roofing Supply Investor Day 2022

Turnaround on Observe but Valuation Remains at Trough Ranges

BECN appears to be to have turned a corner in latest a long time, with the combination of new administration and cyclical tailwinds driving profitability to file ranges. When bears could contend that BECN is in excess of-earning on the back again of cyclical tailwinds, I consider this view probably underestimates the structural development and margin growth prospects out there to the corporation. Assuming administration executes to approach with modest margin improvement of ~100 bps and all over 50 percent of the FCF is funneled towards buybacks although being at 2.5x leverage, BECN could retire a important portion of its shares outstanding in the coming years. With enough growth options also offered (organic and inorganic), BECN stock offers traders with a lot of techniques to gain at the current 8.5x EV/EBITDA valuation.