Cramer says he likes these technology and real-estate stocks for 2023

CNBC’s Jim Cramer on Wednesday highlighted technologies and true estate shares he believes can complete effectively in 2023, pursuing a dismal 12 months for each sectors.

Climbing fascination prices introduced worries for tech and serious estate industries in 2022. Information engineering is down 27{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7} 12 months to date, as of Wednesday’s near, whilst serious estate has fallen 28.4{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7} over the very same extend. The only S&P 500 sectors to perform worse are client discretionary, down 36.2{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7}, and interaction solutions, down 40.3{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7}.

Cramer said he believes tech and authentic estate will proceed to battle future year nonetheless, tech may perhaps commence to see its fortunes enhance soon after the 1st 50 percent of 2023.

Tech picks for 2023

Cramer explained he likes Broadcom’s diversification method, like its pending deal to receive VMware. Broadcom shares also carry a dividend generate all over 3.3{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7}, allowing buyers to be affected individual even though that acquisition goes through regulatory evaluate, he said. The enterprise also lately introduced a $10 billion inventory buyback program.

Palo Alto Networks is not in the S&P 500. Even so, Cramer reported he believes it is really the very best-operate cybersecurity company operating in an market that has extended-phrase keeping ability in the digital age. When Palo Alto Networks described better-than-expected results past month, Cramer pointed out the inventory is not far too far absent from its 52-week closing very low of $142.21 on Nov. 4. “I recommend buying some up now right listed here and perhaps some a lot more into weak spot,” he stated.

Authentic estate picks for 2023

Cramer mentioned he likes Realty Earnings for the reason that its prime retail tenants — these kinds of as Dollar Basic, Walgreens and 7-Eleven — have corporations that can hold up all through a likely economic downturn. “Ideal of all, this firm’s a dividend device they pay a regular monthly dividend,” he said, “and are likely to increase it numerous situations a year. Presently, the stock yields 4.6{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7}.”

When shares of Federal Realty have fallen close to 25{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7} in 2022, Cramer said the inventory has been a good extensive-time period performer. Its recent dividend yield is 4.25{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7}. Cramer stated Federal Realty’s specializes in blended-use houses, quite a few of which are in rich suburbs. That is noteworthy provided fears about a probable economic downturn.

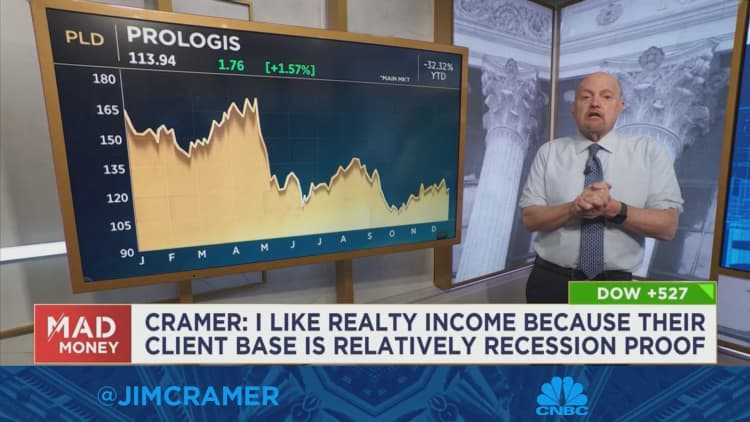

Cramer stated the logistics targeted actual estate expense believe in, or REIT, has continued to flip in potent benefits even as its stock has fallen around 31{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7} 12 months to date. Cramer claimed he thinks Prologis shares have tumbled far ample to start searching attractive.