Prepare for a recession this summer, a bear market in real estate and a drop in stock prices, warns strategist David Rosenberg

Inflation has turned out to be not-so-transitory, and the Federal Reserve has its knives out. Well, its hammer, anyway.

Raising interest rates — the U.S. central bank’s primary tool to restrain runaway prices — is a blunt instrument, at best, and until now, Fed Chairman Jerome Powell has been reluctant to reach for it, let alone use it.

David Rosenberg expects the Fed’s attack on inflation, which begins Wednesday with the first of an anticipated series of interest-rate increases, to slay the U.S. inflation dragon — at a high cost.

Investors accustomed to easy money and meteoric gains in stocks, real estate and other rate-sensitive assets understandably hope for and even expect the Fed to engineer a Goldilocks-like soft landing for the U.S. economy.

But Rosenberg, the widely followed president and chief economist and strategist of Toronto-based Rosenberg Research & Associates Inc., is convinced that the Fed will beat inflation so hard that the U.S. economy will slide into recession as early as this summer.

In fact, Rosenberg sees evidence of a slowing economy already, which for him makes the Fed’s timing questionable and only amplifies his recession call — a cycle that may not end with just one recession. It took two painful recessions, in 1981 and 1982, for then-Fed Chairman Paul Volcker — the patron saint of inflation fighters and Powell’s role model — to bury a decade’s worth of inflation and resurrect the U.S. economy and stock market.

Rate increases depress demand, but when taken too far, crush it. The resulting recession is negative for home prices, consumer-discretionary stocks and nice-to-have goods and services, and positive for Treasury bonds and the producers and purveyors of consumer staples, health care and medicine, energy, food and other things people need to have.

Investing under such conditions is challenging and selective, but investors must play the hand they’re dealt. Earlier this week in a telephone interview, which has been edited for length and clarity, Rosenberg detailed his recession case and suggested where to put your money so you have a chance to profit from whatever cards Mr. Market turns over.

Unsurprisingly, Rosenberg’s economic and market outlook is not popularly shared at the moment. But as he likes to say: “Forewarned is forearmed.”

MarketWatch: Inflation concerns are front and center. Recession is distant and downplayed. Yet you have just published a “recession tool kit” for investors. Why now?

Rosenberg: The timing came from Federal Reserve Chairman Jerome Powell. A couple of weeks ago, Powell said [former Fed Chairman] Paul Volcker was the “greatest public servant.” That’s all you have to hear. How did this greatest of them all kill inflation? Through back-to-back recessions in the early 1980s. Volcker is credited for ushering in a secular two-decade long bull market and economic expansion, but only by destroying inflation through back-to-back recessions.

It would be wonderful if the Fed was adept at growing food and pumping oil and resurrecting broken supply chains, but the only way the Fed will be able to curb the cost-push inflation we have right now is through a recession. It’s going to take demand destruction to get inflation down.

MarketWatch: “Demand destruction” means bursting asset bubbles and that typically means lower valuations for housing, stocks and other cherished investments. You’re on record about residential real estate being at “peak housing.” What convinces you that the U.S. housing sector is in a bubble?

Rosenberg: The housing market is in at least as big a bubble as the stock market. When you look at price action, it’s absolutely incredible. The year-over-year trend in nationwide home prices is 19{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7}. We’ve already taken out prior bubble peaks in the late 1970s, mid-’80s and mid-2000s.

“ ‘We’re going to have anywhere from a 20{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7} to 30{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7} bear market in residential real estate, and that’s being charitable.’ ”

Relative to overall inflation, housing is overvalued by 35{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7}, and 27{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7} relative to wages. Home prices relative to residential rents are 25{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7} overvalued by the standards of the past. A single-family home now absorbs more than eight years of Americans’ personal income, which is almost 50{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7} higher than the average going back to 1968. In a normal market it takes five years of income to buy a single-family home.

Housing, like equities a long-duration asset and benefitting from years of accommodative monetary policy, is again ensnared in a mess of a price bubble. The price-to-income multiple is just about where it was in 2006 and 2007. Nobody wanted to believe it then, and talking about housing being in a bubble today, it’s as if I told somebody that their kid was ugly.

MarketWatch: How hard could this next recession hit U.S. home owners?

Rosenberg: Historically, home prices go up one- to two percentage points above the inflation rate. Right now it’s going up 12 percentage points. Residential real estate is a great hedge against inflation. But the excess is practically unprecedented. The laws of mean reversion are telling you that we’re going to have anywhere from a 20{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7} to 30{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7} bear market in residential real estate, and that’s being charitable. And once again, nobody seems to believe it, let alone prepare for it.

“ ‘The Fed hiking rates usually leads to bad things for the economy.’ ”

What ultimately pulls the rug out from under the housing market is the Fed, because housing is the most interest-rate-sensitive segment of the economy. Each Fed-induced pricking of the real-estate bubbles also played a big role in the eventual recession when you consider the importance of this sector and its multiplier effect on the broader economy. You can’t think that housing is going to respond to a rising rate cycle in the same way it responded to a declining rate cycle.

Fed steps, missteps and delays

MarketWatch: The Fed is raising interest rates now to cool inflation and guide the economy to a soft landing. How much confidence do you have in the central bank’s ability to achieve this?

Rosenberg: The Fed hiking rates usually leads to bad things for the economy. The Fed’s ability to guide the economy into a slowdown without generating a contraction is a one-in-four bet, historically. We have the Fed right now hiking rates into a flat yield-curve and into super-elevated geopolitical risk and a very wobbly capital market. Real rates, which give you a view of what the bond market is telling you about growth, is now heading deeper into negative territory. The only reason why nominal bond yields are going up is that inflation expectations have really taken off. Real rates are going more negative.

“ ‘I don’t envy Jay Powell one bit.’ ”

Some of the key economic-sensitive components of the stock market are either in steep correction or a bear market: consumer cyclical services stocks, which includes restaurants; auto stocks; homebuilding stocks; media and advertising stocks, and small-caps, which are always the canary in the coal mine and are truly reflective of the domestic economy. They’re telling you that recession is imminent. The ADP national employment report showed that employment contracted in February in the small-business sector. All the hiring was in the large business sector. Small businesses always lead the turning point in both directions, because the small-business sector is in the weeds of the real economy.

MarketWatch: To that point: Should the Fed be hiking rates now, with the U.S. economy just emerging from the pandemic and geopolitical risk flaring in Europe and Asia?

Rosenberg: It’s very clear that the Fed is concerned about its credibility and is under tremendous political pressure to raise interest rates. I’ve never seen a White House pressure the central bank to raise rates — it’s usually the other direction. But [President Joe] Biden is getting blamed for inflation and sees that as the primary risk. The problem for him is going to be at the midterm elections because to generate disinflation is going to cause quite a bit of pain in the real economy.

Read: Four things to watch at conclusion of Fed meeting on Wednesday

If I were at the Fed I would do a much better job explaining why now is not the best time to raise interest rates, given all the uncertainty, and give a better definition of what transitory inflation really means. But the Fed feels its credibility is under attack and it’s coming under pressure from Wall Street, academia, the media and the political class to start raising interest rates. I don’t envy Jay Powell one bit.

MarketWatch: Critics say the Fed should have shut the money spigot already, and that the delay has only made a bad situation worse. Where do you stand on this?

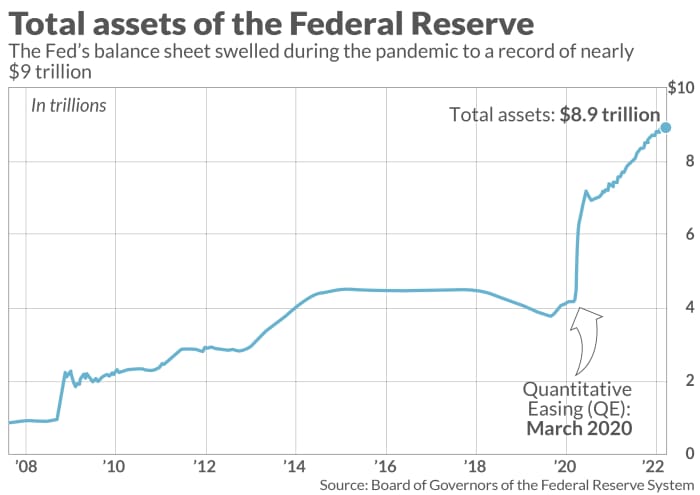

Rosenberg: I would have ended QE a long time ago. Quantitative easing did nothing for Main Street. It just made people on Wall Street even richer. Why the Fed was still buying mortgage-backed securities last year, when the housing market was on fire, and why the Fed decided that accommodating all that fiscal boondoggle and stimulus checks in March 2021 when the economy was opening already, is anybody’s guess.

“ ‘ I would not be adding more uncertainty by tightening monetary policy right now. But the Fed has boxed itself in.’ ”

One could say that maybe the big mistake was not responding earlier. The time to have begun the process of normalizing policy was a year ago. But that ship has passed. I would not be adding more uncertainty by tightening monetary policy right now. But the Fed has boxed itself in. It’s really a question of how much they want to ratify the seven rate hikes that are priced into the market between now and the end of the year.

If Powell wanted to talk the market out of that expectation at his recent congressional testimony, he would have done it. But he chose not to. At this stage, it’s probably not a good idea to start raising rates aggressively. I’m not sure 25 basis points is going to make a big difference, but the market is priced for a lot more by the end of the year.

David Rosenberg

Rosenberg Research

Where to put your money by summer

MarketWatch: Let’s break open the recession tool kit. What should investors watch for — and watch out for — if and when the economy shifts into reverse?

Rosenberg: As we head into the recession, you want to have a cash reserve. The notion that cash is trash gets trashed. Cash will provide you with resources to buy assets that are deflating and will deflate further.

“ ‘You want to be very strategic. Limit the amount of economic sensitivity in your portfolio and be very defensive.’ ”

You want to be very strategic. Limit the amount of economic sensitivity in your portfolio and be very defensive; that’s why consumer staples tend to do much better than consumer discretionary. Restaurants, for example, tend to underperform grocery chains. Be in utilities, consumer staples, health care.

Military budgets are going up around the world, so defense stocks are a great hedge against elevated geopolitical risk. Security of supply, food in particular, is going to put a premium on farmland in stable parts of the world. Europe is going to now be forced to diversify its energy sources, which is great news for liquid natural gas exports from North America and other potential clean energy sources like nuclear and uranium.

With commodities, we have an unusual situation where the CRB index has been hitting new highs and yet the S&P materials stocks are almost in correction territory. We’re seeing a divergence between materials stocks and the actual commodities. When you start to see that diversion, Mr. Market is telling you that the price action in the resource sector has been so aggressive, it’s leading to demand destruction. You want to be very selective in commodities. Check out what steel has been doing; it’s not a pretty picture.

“ ‘The higher bond yields go, the greater they’re going to fall.’ ”

MarketWatch: Bonds are taking it on the chin, but you’re also on record that investors now are undervaluing Treasurys, much as they overvalue most stocks.

Rosenberg: I think we’re going into a blow-off on Treasury yields that is going to be an attractive entry point. One thing about recessions is that, stagflationary environment or not, Treasurys

TMUBMUSD10Y,

TMUBMUSD30Y,

usually do generate positive returns.

The higher Treasury yields go, the greater they’re going to fall. In the blow-off we could go up another 25 or 50 basis points. That is a dip in bond prices I’d be willing to buy premised on my economic view and knowing the history of the bond market. Yields tend to drop in economic recessions. We’re staring one in the face. It’s just a matter of time.

“ ‘We are more than 80{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7} of the way through this cycle. That would put a recession starting sometime this summer.’ ”

We’re already in a recession when it comes to real wages. Real average weekly earnings have been negative now for five months in a row, and six of the past seven. There’s over a 90{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7} correlation between real spending and real incomes, and just a lag of a few months that separate the two. We have a proprietary late-cycle indicator that includes a variety of different market and macro variables. They’re telling us that we are more than 80{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7} of the way through this cycle. That would put a recession starting sometime this summer — as early as June and as late as August. It’s going to be either a second-quarter or early third-quarter event.

MarketWatch: You often say “forewarned is forearmed.” If what you predict plays out, it seems the Fed will have missed that warning. But investors can still heed it.

Rosenberg: We are living through an epic period in financial and economic history. We had a global pandemic, which nobody was prepared for. We had irresponsible fiscal largesse with gigantic tax cuts at a time of full employment in the last administration that left a lot of the cupboard bare for fiscal policy.

Then we had the Fed coming into this crisis with the funds rate at 1.75{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7}. Normally the Fed cuts rates five percentage points in a recession; they didn’t have that flexibility this time, which is why they had to blow up the balance sheet. The balance sheet is hitched to asset inflation. So the next thing you know, to fight the global pandemic and a lockdown that created severe dislocation for the economy, the Fed eased policy 825 basis points in a two-year span when you combine the balance sheet and the rate cut together. No wonder we had asset bubbles everywhere.

What happens when we rewind? I’m trying to get my clients prepared. My job is not to make them happy. If my job was to make my clients happy, I would have created Rosenberg Circus instead of Rosenberg Research.

More: Goldman cuts U.S. GDP forecast as it says recession odds are as high as 35{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7}

Also read: A bet on stock-market volatility might saddle investors with hundreds of millions in losses, as Barclays makes a big change to funds