Resiliency on the rise in roofing

relaunched Timberline

UHD (Ultra High Definition)

shingles as Timberline UHDZ

shingles. This new premium

laminate shingle offers the

company’s patent-pending

Dual Shadow Line which,

according to GAF, creates

shadows that mimic sunset

all day long, as well as 10{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7}

more of GAF’s Time-Release

Algae-Fighting Technology.

Have you ever stopped to think about hats? From Indiana Jones’ signature fedora to Sherlock Holmes’ deerstalker to Abraham Lincoln’s stove-pipe top hat, head-covering caps have been used as a critical element of weather protection for centuries. In fact, the oldest known example of hat wearing goes back to ancient Egypt and a depiction found in a tomb in Thebes dating back to 3200 BCE of a man wearing a conical straw hat. The first hat we know of to have a brim of sorts comes from ancient Greece. Known as a petasus, the hat’s wide brim protected the wearer from the sun and rain while a strap allowed wearers to secure it under the chin.

Just as hats protect our heads from sun and wind, roofing products also protect our homes from the environment. Unfortunately, the roofing industry has suffered its share of turmoil over the last few years, due in no small part to the COVID-19 pandemic that brought material shortages, transportation woes, canceled jobs, and layoffs. Enter 2023, and national economic worries are adding even more uncertainty to the mix.

According to the U.S. Census Bureau, new authorized building permits in November 2022 for privately-owned housing units were at an annual rate of 1,342,000—that’s 22.4{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7} below the same time in 2021. Similarly, housing starts in November 2022 were at an adjusted annual rate of 1,427,000, a statistic that’s 16.4{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7} below November 2021. Considering these statistics, it’s no wonder LBM dealers are scratching their collective heads trying to figure out what’s to come over the rest of the year. But according to manufacturers of roofing products and systems, there’s much more to the story.

Slow but steady wins the race

While the numbers don’t lie, they also don’t tell the entire story. While roofing product manufacturers agree with the potential for sluggish growth, they also see opportunities in 2023. “While the single-family segment may see a dip in growth, several forecasts anticipate repair and remodel to be strong in 2023,” says Casey Smyth, OSB/EWP brand manager for LP Building Solutions. “Also, the multifamily segment has really been one of the strongest markets in 2022, and models anticipate that it will continue to grow in 2023. Regardless of demand, housing remains underbuilt in this country. The National Association of Realtors estimates that there is a shortage of 5.5 million homes in the U.S. Despite the challenges of the industry, LP is optimistic about the growth of the market and will continue to provide builders with solutions that will allow them to build homes they are proud of.”

Bobby Byrd, director of OSB sales and marketing for RoyOMartin, also agrees with the potential for slower growth, but sees bright spots in the forecasts. “While we do expect things to be slower over the next year, the fact remains that nationally we are still in a housing deficit with the latest numbers indicating that we are only at just over three months’ supply,” he explains. “A balanced market is six months of supply. Another trend that we are seeing is that many sellers are holding back on listing their existing homes because they aren’t real excited to trade in their sub 3{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7} mortgage interest rate for the now 6+{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7} rate. We can’t blame them! Demand is still there, and it has to be filled somehow. While we won’t see the level of starts that we’ve seen over the last couple of years, people will still build homes, and builders/investors will still build multi-family housing. We will see an increase in multi-family and modular home builds over the next year, and those are the segments we will see grow.”

Another bright spot in the repair and remodel arena can be chalked up to record levels of homeowner equity, says Doug Sloane, director of product management, building materials group, for PrimeSource. “While the market will soften in 2023, Americans have never had as much home equity built up as they do currently. With that in mind, we think the repair and remodel segment is headed for significant growth. As homeowners upgrade or paint their exteriors, there will be a need to ensure the roofing color matches up with the color of the home. Overall growth will be down, but there is absolutely an opportunity for sales in the LBM channel to increase.”

Unfortunately, some growth will be coming from less than positive factors—namely, severe weather. According to the NOAA National Centers for Environmental Information (NCEI) 2023 report entitled “U.S. Billion-Dollar Weather and Climate Disasters,” there were 18 weather/climate disaster events with losses exceeding $1 billion each that impacted the United States in 2022.

“Interest in advancing roof design in materials continues, we believe, in part to historic levels of storm-related damage,” explains Kristin Michael, growth marketing manager for Huber Engineered Woods. “We anticipate continued demand to learn and try better approaches to storm-proofing this critical area of the building envelope. Our integrated sheathing, tape and peel-and-stick underlayment line continues to grow in interest and adoption as builders look to meet quicker rough dry-ins balanced with long-term durability.”

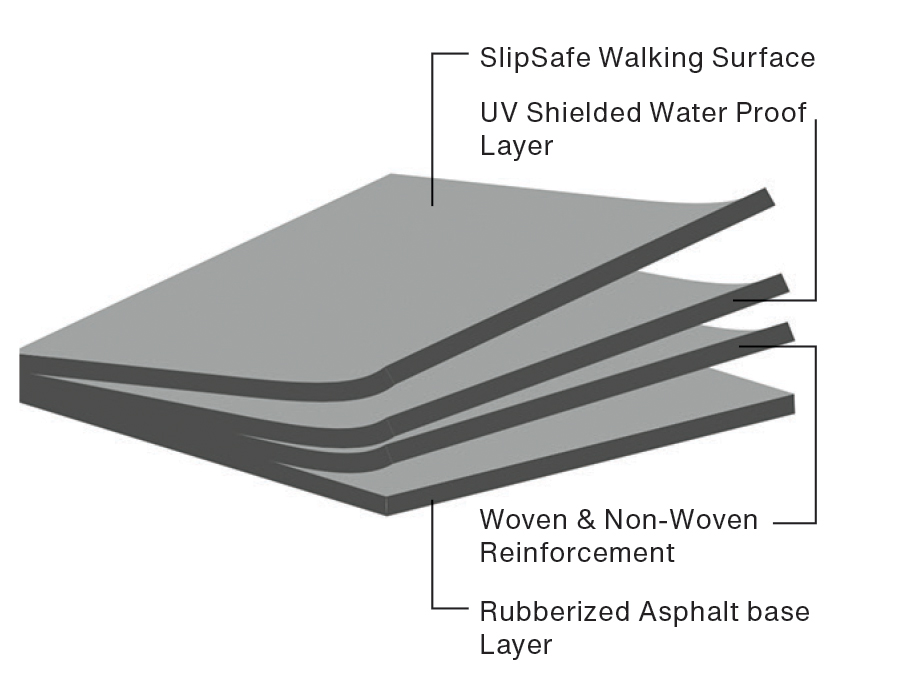

Alex Barrego, product manager of proprietary building materials for PrimeSource Building Products, also sees weather events playing a hand in the growing demand for advanced roofing products. “Relative to PrimeSource Building Products and the response we’ve already witnessed to new roofing products—specifically Grip-Rite ShingleLayment-HT—we expect the roofing accessories category to remain strong,” he says. “Reroofs and natural disasters are market drivers. Severe storms, as well as hail, hurricane and tornado season (not to mention ice and water damage) are all constants that drive the market on an annual basis, so annual repair of some sort is guaranteed.”

This year, sadly, has already seen its share of severe weather, and LBM dealers in disaster-prone areas of the country should make plans to deliver in the wake of those events, especially as those repairs aren’t tied to economic fluxuations, says Ann Iten, director of marketing for Westlake Royal Building Products. “Despite the current state of inflation and the economy, we continue to see growth in the re-roofing market. Specifically, we are witnessing a significant number of older or worn roofs that will require replacement. Additionally, the growing frequency of severe weather events is driving demand for our roofing products, which provide weather resiliency benefits.”

Resiliency on the rise

In part because of the increased occurrence rate of severe weather events, more builders and homeowners than ever are turning to resilient roofing products, particularly because of their ability to withstand extreme environmental conditions. In part, resilient design— the intentional design of buildings, landscapes, communities, and regions in order to respond to natural and manmade disasters and disturbances—focuses on the ability of structures to not only withstand extreme conditions but do so while delivering energy efficiency to help fight long-term climate change. It’s a concept, industry expert say, which is only going to increase.

“Resiliency is the operative word in sustainability within roof deck design and construction,” says Huber’s Michael. “We see a growing interest every year, particularly in coastal regions, but also as an element of building science conversations throughout the country, in which building teams are exploring the best way to manage control layers in the building envelope for a more durable structure overall.” With the ever-growing impacts of climate change and increasing frequency and intensity of weather events, says Westlake Royal’s Iten, a resilient roof makes sense in durability and energy efficiency for both heating and cooling. “Energy efficient roofs also reduce greenhouse gas emissions, which are a major contributor to global warming,” she explains. “Likewise, the ability of the roof to better withstand inclement weather conditions and events has become critical. At this point, many consumers are aware of the importance of both energy efficiency and resiliency. Thus, demand for these solutions is much more prevalent among the end user today.”

Organizations such as The Insurance Institute for Business and Home Safety (IBHS), the Federal Alliance for Safe Homes (FLASH), and The Weather Channel are actively working to spread the message and benefits of resilient design, and LBM distributors should be prepared to answer the increasing need of such products. “We are seeing a general trend towards resilient design and material consideration in roofing applications, coupled with interest in education for proper installation,” says Huber’s Michael. “Resiliency is all about reducing risks, and in roofing, this comes down to preventing leaks. Having the right combination of products and best installation practice to meet each project’s design and location needs is crucial in creating a high-performance building envelope.”

Sustainability stays vital

If resilient design is one side of the trend coin that LBM dealers need to be prepared to flip, then sustainable design is the other. In short, sustainable design seeks to reduce negative impacts of a building on the environment and on the building’s occupants by increasing a structure’s performance and comfort while reducing waste and the consumption of non-renewable resources.

“We often have builders asking about sustainability solutions because energy efficiency is becoming more and more top of mind not only for builders but also for homeowners,” LP’s Casey Smyth points out. “Builders have told us about an increase of homeowners opening the conversation about sustainable building, rather than the other way around. LP’s approach is that sustainability starts with resilience. The suite of LP Structural Solutions products works to target key industry challenges to create more resilient homes that are built to last. Each product of the portfolio is engineered to stand up to both the normal wear-and-tear of everyday life—like heat and moisture—as well as more severe weather conditions.”

James Alpeter, marketing manager of stone/ siding/roofing for ProVia, agrees with that assessment. “I believe that sustainability is becoming more top-of-mind for all consumers, not just specific age groups as it has been in the past,” he says. “Customers are looking for alternatives to traditional roofing materials that typically produce more waste and are difficult if not impossible to recycle. I think the market is starting to see a slightly less price-conscious consumer; one who values the integrity and longevity of a product and manufacturer over just the bottom line.”

Aesthetics always a player

All the interest in resiliency and sustainability doesn’t mean color and style aren’t vitally important. In fact, they remain some of the most important factors in the purchase decision. Manufacturers point to cool gray color palettes, dark and light brown hues, and natural shades of blue and green as continuing to grow in popularity, and roofing product manufacturers are going to great lengths to make sure their product lines mesh with consumer desire.

“Westlake Royal Roofing Solutions recently commissioned a professional study about trends related to home architecture and roofing,” explains Iten. “What we found was that, unsurprisingly, the pandemic greatly impacted how we utilize our homes, but also influences design and roofing preferences that, of course, include color.”

According to Westlake Royal’s study, the three key macro influences to design and roofing trends were naturalism, disruptions, and ease. As Iten describes them, naturalism represents a shift toward rural-inspired and contemporary escape homes, with two- and three-color palettes in hues evoking weathering by nature (for rural-inspired homes) and darkened and refined hues (for contemporary escapes).

In the case of disruption, Iten describes it as an architectural style that evokes what she calls the new glamour of opposites. “Two sub-styles emerge from this influence and include homes firstly in the clean traditional and secondly in the merged aesthetic styles,” she says. “Clean traditional homes are often presented in two-color palettes showcasing hues that are high-contrast opposites, while homes in the merged aesthetics style are often presented in two-color palettes in true traditional tones.”

Lastly, the study identified ease as the third macro influence, a design style that has led to a shift toward a more quiet, calm approach. Two types of quiet design homes—quiet transitional and quiet modern—are presented in one- and two-color palettes of easy muted neutral toned hues.

Solutions for labor shortages

The ability to identify trends is one thing; being able to deliver products that meet those trends is another. The continuing labor shortage, along with long lead times for raw materials, is impacting manufacturers’ ability to get product out the door. “This is a big problem right now, says David Delcoma, operations manager for MFM Building Products Corp. “Some raw materials are still on allocation or have extended lead times. With the recent storms, some items may become even more difficult to find and stock. Our lead times have remained relatively short, but some items have been pushed out like 3-4 weeks. In terms of the labor force, there is a big lack of tradesmen and people willing to work in a factory setting. We continually advertise for production people and if they have a decent level of skill, we’ll hire them.”

Huber’s Kristin Michael points to a dedication to clear communication and relationship building as a key to overcoming those manufacturing labor shortages. “We are fortunate to partner with some of the hardest-working men and women in the industry to meet building teams needs nationwide,” she says. “We are committed as ever to leaning into the strong communications and relationships established with our network of dealers, distributors and suppliers as we move into the next year. True to our innovative spirit, we have a steadfast focus on planning and adapting to landscape shifts and pursuing trusted solutions to keep pace with our industry’s changing needs.”

LP’s Casey Smyth agrees with the need for clear communication—both internally and externally—to help offset labor shortage challenges. “While there are a lot of unknowns involved in the supply chain, LP remains proactive in our approach of making sure builders have the products they need when they need them,” he explains. “We work closely with our rail and trucking partners to stay updated regarding transportation of our products. We also have close communication with our internal team on the raw material procurement side. The bottom line is that proactive communication is critical for all parties when it comes to supply chain management, and LP strives to be a transparent partner to the folks who buy and build with its products.”

Of course, the lack of available labor is impacting contractors as well. “The roofing industry is certainly facing an ongoing labor shortage within its contractor base,” points out Westlake Royal’s Iten. “A segment of the industry’s labor force is aging and retiring, while simultaneously, there’s an on-going struggle to recruit enough new contractors to replace those retiring and to meet demand.”

As a result, roofing manufacturers are striving to create products that offer solutions in the form of ease of installation. “Labor shortages will drive the use of more user-friendly products,” says PrimeSource’s Barrego. “Lighter weight rolls like Grip-Rite ShingleLayment are less labor intensive to install, as are peel and stick products that a single installer can easily manage, as opposed to teams of installers.”

Billy Webb, structural solutions product manager for LP Building Solutions, points to efforts the company has taken to make builders’ lives easier. “One way that we do this is by making building products that can add resiliency and eliminate added installation steps,” he explains. “Both LP TechShield Radiant Barrier and LP WeatherLogic Air and Water Barrier panels install just like normal sheathing but boast added benefits that are tailored to the builder’s climate.”

Manufacturers also point to strategies LBM dealers themselves can put in place. “The shrinking labor pool of skilled installers is a growing obstacle the industry will need to work hard to overcome,” says ProVia’s Alpeter. “One way for building professionals to help is to work closely with local trade schools to educate students on what type of salary a roofing crew member, leader, and business owner can expect to make. Train and develop talent early; nurture relationships at every level. Crews may also find good summer help when labor shortages are at their worst,” he stresses.

“Have a clear vision of what products have to be on the floor,” reminds MFM’s Delcoma. “No product equals no sale. Purchasing needs to find out lead times for items and order accordingly. For MFM, we have become multi-sourced for each component and always ensure product is on the floor.

In looking at what may be in store for the roofing segment over the next twelve months, the potential for a sluggish environment is very real. Fannie Mae expects a modest recession to begin in the first quarter of 2023. This doesn’t mean, however, that LBM dealers can’t find significant wins. Through opportunities in the repair and remodel market, coupled with the ability to informatively educate and communicate with their customers, LBM dealers can come out ahead in roofing despite economic fears. As ProVia’s Alpeter stresses, it’s all about selling the benefits. “Any time there is talk of a recession and inflation, consumers are going to be reluctant to make large purchases. Sales of higher-end roofing products will require a focus on quality, long-term benefits, and cost savings. The industry needs to get consumers to think beyond current economic fears and show them that a roof is a smart long-term investment that will increase their home’s value.”