The housing market has cooled so much that even deep-pocketed investors are backing off

Imagine getting outbid for a solitary family members residence by a company. That was all as well authentic for the final couple yrs as investor genuine estate purchases surged, fueling the Pandemic Housing Growth and and pricing lots of aspiring property potential buyers out of the marketplace.

Past 12 months the average 30-calendar year fastened property finance loan price rose to around 7{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7}. The yr in advance of, home loan premiums ended up at historic lows and demand from customers was higher, which fueled an investor frenzy within just the housing industry. Genuine estate brokerage Redfin’s new report shows just how a lot of a difference there is in investor residential real estate buys amongst the two many years.

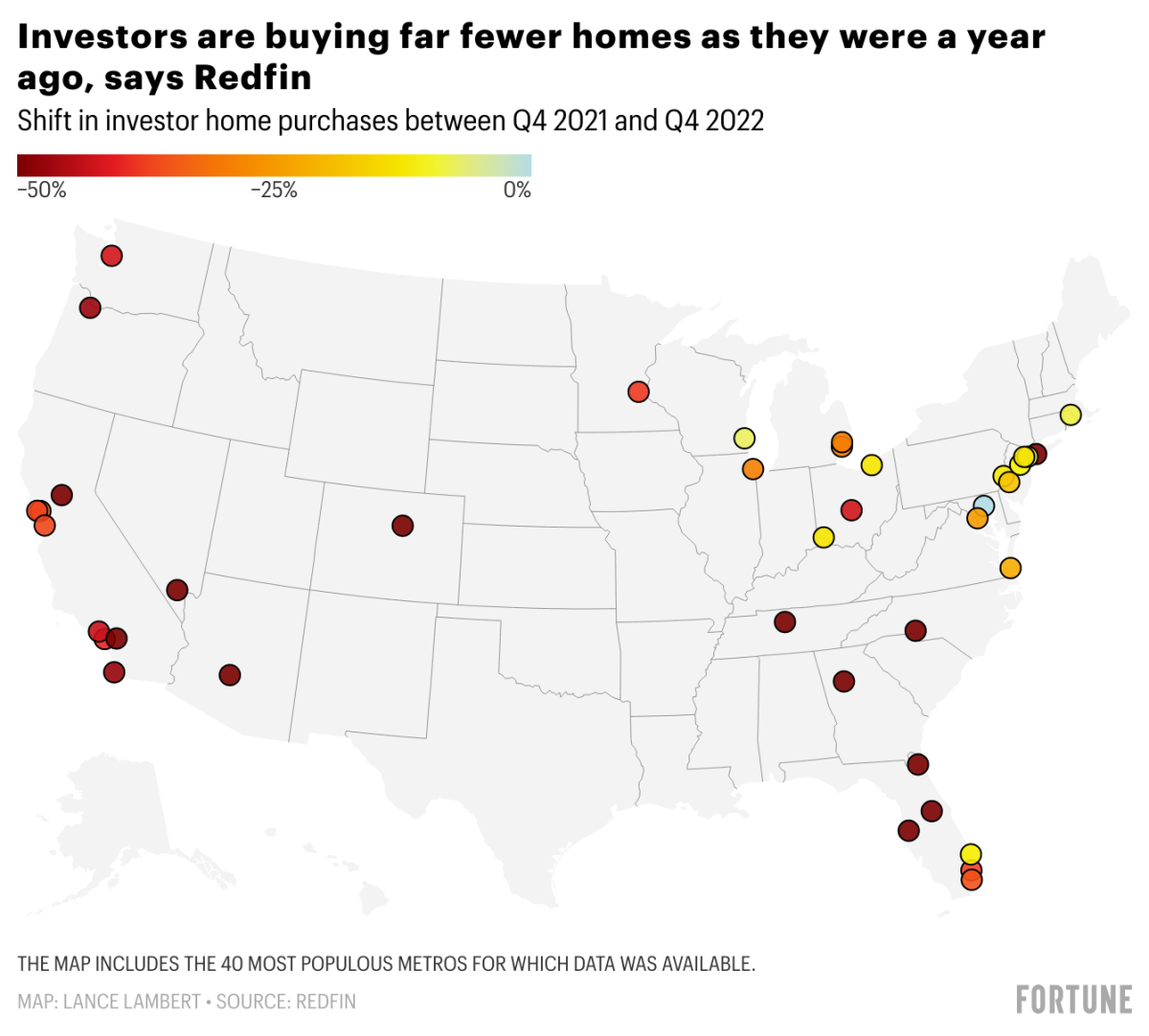

In the fourth quarter of 2022, investor dwelling purchases plunged 45.8{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7} as opposed to the same period the former 12 months, as house loan premiums rose and residence selling prices declined, Redfin researchers wrote. To increase some standpoint, the 2008 housing crisis noticed a a little scaled-down decline with trader purchases falling 45.1{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7}.

For this report, researchers analyzed county information throughout 40 metropolitan parts in the U.S., and they define “investor” as any establishment or enterprise that buys residential real estate.

See this interactive chart on Fortune.com

“Investors piled into the housing market in 2021 owing to rock-bottom home loan charges and surging housing desire, and are now retreating amid projections that household price ranges have room to slide,” the report mentioned.

Pandemic boomtowns like Las Vegas and Phoenix are currently seeing sharp corrections. In Las Vegas, trader property buys fell 67{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7} in the fourth quarter of very last year versus a yr earlier, which Redfin’s researchers identified to be the premier decline amid the 40 metro spots they appeared at.

Phoenix saw a 66.7{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7} decline in the very same interval. Meanwhile, Nassau County skilled a 63{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7} drop, Atlanta a 62.8{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7} drop, and Charlotte a 61.9{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7} fall. All of which manufactured up the major half of the 10 premier declines Redfin has claimed. The other 50 {7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7}, in accordance to the report, provided: Jacksonville (down 57.1{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7} in the fourth quarter of 2022 from the prior year), Nashville (-54.8{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7}), Sacramento (-53.5{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7}), Riverside (-53.{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7}), and Orlando (-51.8{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7}).

Some of the smallest declines, of a lot less than 10{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7}, have been witnessed in Milwaukee, New York, and Providence. Meanwhile, Baltimore was the only metro metropolis Redfin analyzed with an maximize in trader household purchases, growing 1.4{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7}.

Curiously adequate, there’s also been a change in what accurately traders are obtaining. Redfin’s scientists located that investor buys of one loved ones houses dropped 49.8{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7} year-in excess of-calendar year in the fourth quarter of 2022. The decline is the biggest of any other other assets variety. For instance, trader purchases of condos dropped 35.6{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7} and buys of multifamily housing qualities dropped 31.1{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7}. But regardless of it staying the largest decline, solitary loved ones households are continue to the well-liked choice between buyers.

And investors that are obtaining households are tightening their purse strings, with buys of large-priced and mid-priced households both equally declining by additional than 50{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7}. Meanwhile, investor purchases of reduced-priced houses dropped 28.6{7e5ff73c23cd1cd7ac587f9048f78b3ced175b09520fe5fee10055eb3132dce7}, in accordance to the report.

Even so, home loan fees have dipped marginally this 12 months and some marketplaces are observing an uptick in activity with the get started of the hectic year, so trader fascination could be piqued.

“It’s attainable that traders will start to wade back again into the sector this 12 months supplied that home loan fees have ticked down from their 2022 high—especially if home prices present symptoms of bottoming,” Redfin’s senior economist and researcher on the report, Sheharyar Bokhari, mentioned. “But it is unlikely that investors will return with the exact vigor they had in 2021.”

And that could basically be superior information for specific customers, Bokhari additional, in that they could no lengthier shed bidding wars to traders.

Where by are U.S. residence costs headed following? This is the unique forecasts from 29 top real estate investigate firms.

Goldman Sachs just manufactured a bold housing market place call—listed here it is

How property costs are expected to change in above 300 housing markets, according to up-to-date forecasts from Zillow and Moody’s

This story was at first showcased on Fortune.com

More from Fortune:

5 side hustles in which you may well receive over $20,000 for every year—all even though doing work from dwelling

Millennials’ average web value: How the nation’s largest operating generation stacks up in opposition to the rest

The finest 5 means to generate passive revenue

This is how much money you will need to earn on a yearly basis to easily acquire a $600,000 house